Bowes & Associates Protects You from Expensive and Exhausting Audit Risks!

Fix errors, organize your records, and get expert guidance to avoid penalties down the lane.

Why Would the IRS Choose Your Return for an Audit?

Being audited doesn’t always mean you’ve done something wrong. On a separate note, here’s what could have led to it

- Random Selection: Sometimes, the IRS picks returns randomly for an audit.

- Computer Screening: The IRS uses statistical formulas to flag returns that need a closer look.

- Linked to Another Audit: If your return is connected to someone else’s return that was flagged for an audit, yours might also be reviewed.

Critical Red Flags to Watch for in IRS Tax Audits

High Income

The IRS focuses more on higher-income earners because there’s more money at stake. The more you earn, the more likely you are to be audited.

Unreported Income

If the income you report doesn’t match what the IRS receives from your employer or clients, it raises a red flag. Make sure all income is accurately reported to avoid this.

Too Many Deductions

Claiming a lot of deductions, especially for things like charitable donations or business expenses, can trigger an audit if they seem unusually high compared to your income. The IRS wants to ensure your deductions are legitimate.

Simple Mistakes

Even small errors, like typos or math mistakes, can lead to an audit. The IRS checks for accuracy, so it's important to review your return carefully before submitting it.

Home Office Deduction

This deduction is valid, but it’s often misused. The IRS looks closely to see if the home office deduction is justified based on your work situation.

Big Cash Transactions

The IRS gets notified if you deposit or receive more than $10,000 in cash. This can prompt a closer look to ensure everything is reported correctly.

Bowes & Associates Makes it a Goal to Protect Your Rights

Want to Know How?

- We catch issues early before they trigger an IRS audit.

- Our team fixes mistakes that could cost you big.

- We protect your assets from severe IRS actions and collections.

- We help lower penalties and negotiate simpler payment options.

- Our professionals take the burden of the stress, so you don’t have to.

- You can access our support anytime, anywhere in the U.S.

Stay One Step Ahead of IRS Audits with Bowes & Associates

Our experts fix errors, reduce penalties, and protect your assets before the IRS even knocks.

Get Full Protection and Preparation for IRS Tax Audit

IRS Tax Audit Representation

We speak directly to the IRS on your behalf, so you never have to face them alone.

Negotiate an Offer in Compromise

Can’t pay your full tax liability? We negotiate with the IRS to reduce the amount you owe to something manageable.

Tax Audit Advice and Planning

We offer practical advice and planning to help you navigate the complexities of tax audits with confidence.

Individual and Business Tax Consultation

Whether you’re an individual or a business, our consultations are tailored to your unique needs.

IRS Tax Audit Defense

We defend and represent you, ensuring your rights are protected and your case is accurately presented.

Tax Compliance Review

We review your filings to ensure they meet IRS standards. If problems arise, we handle them with minimal stress.

IRS Tax Audit Reconsideration

If you believe the outcome of your audit was unfair, our IRS tax consultant requests an audit reconsideration for a re-evaluation of your case on your behalf.

Audit Risk Assessment

We assess your situation to provide IRS tax audit help to reduce your chances of being audited in the future.

Tax Debt Settlements

If you owe tax debt, we’ll work with you to negotiate a manageable solution with the IRS.

Post-Audit Support

After your audit, we continue to support you with follow-up advice and help to prevent future tax complications.

Get the Representation That Changes the Outcome of Your IRS Audit

The right representation can make all the difference. Avoid costly mistakes, protect your assets, and negotiate better outcomes with experts on your side. Our team handles everything, so you don’t have to face the IRS alone.

We Make You Audit-Ready and Protect Your Rights

Comprehensive Review & Risk Analysis

Our Georgia tax attorney begins by understanding your situation. Even if you’re outside Georgia, we provide the same expert IRS tax audit services nationwide, tailoring our approach to your specific needs.

Review of Financial Records

We go through your financial records, including income statements, deductions, credits, and more, to get a clear picture of your finances. This helps us prepare you for the IRS tax audit.

Fixing & Strengthening Compliance

We look for any red flags that might have triggered the IRS tax audit. After identifying them, we work to correct inaccuracies, optimize your records, and enhance compliance.

Preparing Documentation

Once we understand your finances, we gather and organize the necessary documents. This step is key to making the audit process smoother and ensuring your tax attorney for IRS audit has everything they need.

Pre-Audit Briefing

Before the audit, we brief you on what to expect and how to respond to IRS agents’ questions. This is where you work very closely with your tax attorney for IRS audit representation.

Final Resolution & Peace of Mind

If an audit arises, we’re with you until the very end. Our tax attorney for IRS audit handles all communication with the IRS, negotiates on your behalf, and pursues the best possible outcome.

Bowes & Associates Believes in Transparency, Ethics, and Professionalism!

Facing an IRS audit is undeniably scary. But, truly, it’s easy to come out of it when you have an unbreakable strategy in place. Gain control of your situation with a team that knows the process inside out and prioritizes your interests every step of the way.

What does the IRS look for >during an Audit?

Let’s break down some key areas that their auditors might focus on:

Unreported income: Did every dollar you earn make it onto your tax return? The IRS is keen on checking this.

Deduction claims: Are all your claimed deductions accurate and valid? The IRS will verify this to ensure you’re not underpaying your taxes.

Incomplete income records: Missing some income records on your tax return? This could raise a red flag.

Unfiled tax returns: Have all your tax returns been correctly filled and submitted? The IRS is vigilant about this aspect.

Inconsistencies in income records: Any irregularities in your income records could attract the IRS’s attention.

Does Representation Matter in IRS Audits?

You know what tax audits are, right? But what does the IRS look for when they assess your tax documents? Well, the primary goal of the IRS is to ensure that your reported income aligns with their records and that all deductions claimed are valid.

If you’ve ever asked the question, “Does representation matter in IRS audits?” The short answer is – absolutely. The idea of facing an IRS audit can be daunting, and going through it alone is even more unnerving. This is where professional representation becomes invaluable.

An experienced representative, such as a tax attorney, brings extensive knowledge of tax laws and IRS procedures to your corner. They understand the nuances of the audit process and can provide insightful advice tailored to your situation.

Here are some reasons why professional representation matters in IRS audits:

![]() Knowledge and Experience

Knowledge and Experience

![]() Negotiation Skills

Negotiation Skills

![]() Time and Stress Management

Time and Stress Management

![]() Protection of Rights

Protection of Rights

So, if you’re facing an IRS audit, remember – representation not only matters but can significantly influence the outcome. Trust us to stand by you and help you navigate the complexities of your audit with confidence.

Do I Need a Tax Advisor?

Are you wondering about getting help from a tax professional? Navigating tax laws, especially during an IRS audit, can feel nerve-racking. But that’s where we step in.

We’ve a dedicated team of experienced tax attorneys ready to assist you. If you find yourself in a complex tax situation, facing a high-stake audit, or grappling with legal tax issues, having a tax attorney can be a game-changer.

Personalized Representation

We believe that each client is unique, and therefore, deserves unique representation. We take the time to understand your specific situation and tailor our approach to meet your individual needs. Our tax attorneys are dedicated to providing personalized service, treating your tax concerns as if they were our own. We prioritize your interests and work tirelessly to achieve the best outcome for you.

Team of Experienced Advisors

Our team consists of tax attorneys with years of experience dealing with tax issues and the IRS. They bring a wealth of knowledge and expertise to the table, ensuring that you get top-notch advice and representation. They’re not only well-versed in tax law, but they also understand the intricacies of dealing with the IRS. They’ll stand up for you, vigorously defending your interests.

Unrivaled Results

We’re proud of our track record at Bowes and Associates. Our commitment to achieving unrivaled results for our clients sets us apart. Whether we’re negotiating with the IRS, strategizing for an audit, or representing you in court, we aim for the best possible outcome. Our success is measured by the positive results we achieve on your behalf.

We’ll decipher the legal jargon, explain your rights, represent you in negotiations, and stand by you every step of the way!

Remember, dealing with an IRS audit is not just about the numbers, it’s about having someone who knows the law and can protect your rights.

Together, We can face any tax challenge that comes your way!

But, What Triggers an Audit?

High Income: Those with higher incomes tend to be audited more frequently. As the income bracket increases, so does the likelihood of an audit.

Unreported Income: If the income you report doesn’t match the information the IRS receives from other sources (like your W-2 or 1099 forms), it could raise a flag.

Excessive Deductions: Claiming a high amount of itemized deductions in relation to your income can draw the IRS’s attention. This includes deductions for charitable donations, business expenses, and others.

Errors on Your Return: Simple mistakes like math errors, incorrect Social Security numbers, or missing forms can trigger an audit. It’s important to double-check your return before submission.

Home Office Deduction: While this is a valid deduction, the IRS scrutinizes it closely due to frequent misuse.

Large Cash Transactions: The IRS receives reports of cash transactions exceeding $10,000 and may scrutinize these further. Knowing these triggers can help you better prepare for and possibly avoid an IRS audit. However, even the most diligent taxpayers often encounter an audit.

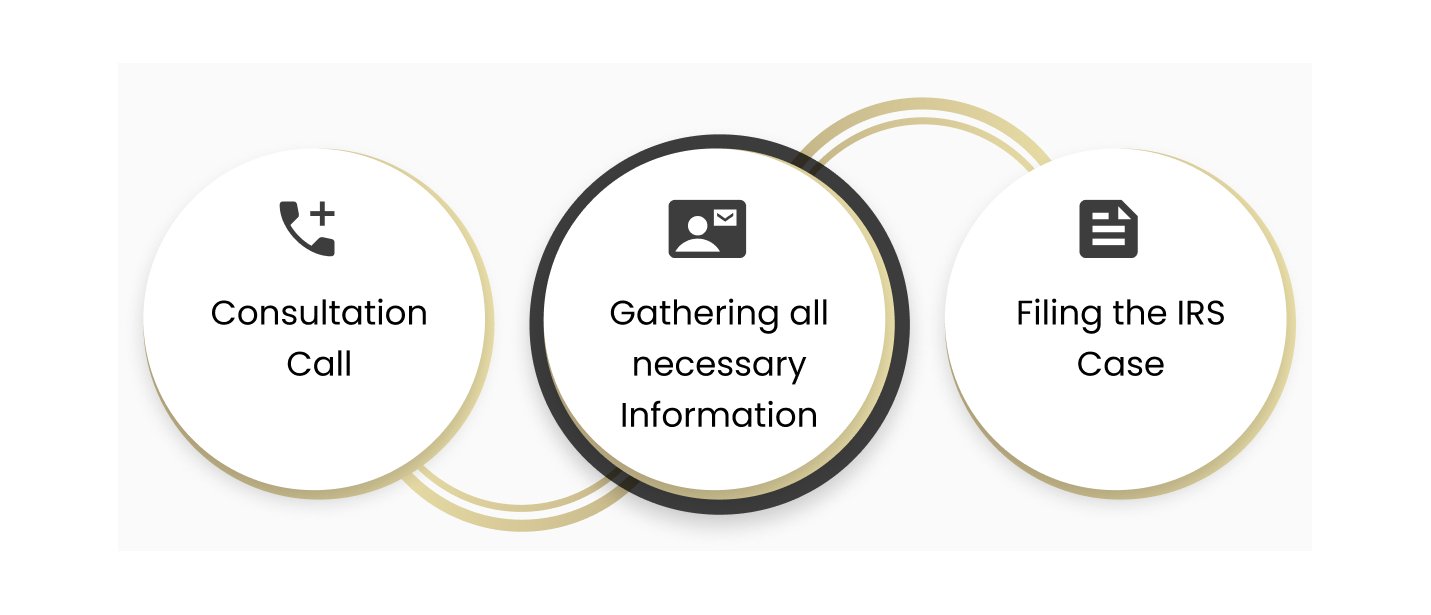

3-Step process to get relief!

How We Prepare You for an IRS Tax Audit?

A Step-By-Step Guide!

Initial Consultation

The first step in our process is understanding your unique situation. We sit down with you to discuss your tax scenario in detail. This helps us understand your needs better and tailor our services accordingly.

Detailed Review of Financial Records

We evaluate your financial records to get a thorough understanding of your finances. This includes income statements, deductions, credits claimed, and other pertinent details.

Identifying Potential Audit Risks

Our expert team will identify potential red flags that might have triggered the audit. We evaluate these areas and formulate strategies to address them.

Preparing Necessary Documentation

With a clear understanding of your financial landscape, we’ll gather and organize the necessary documentation. This is a critical step that aids in streamlining the audit process.

Pre-audit Briefing

Before the audit, we conduct a briefing to help you understand what to expect. We’ll guide you on how to interact with IRS agents, answer their questions, and manage your responses.

Practice Sessions

We believe practice is key to confidence. Our team will conduct practice sessions simulating the audit, helping you feel more prepared and less stressed about the actual event.

Continuous Support and Guidance

Even after the audit, we’re there for you. Whether it’s handling follow-ups with the IRS or providing advice on avoiding future audits, we’re with you every step of the way.

Why are we your Ideal Partner in IRS Tax Audit?

We’re more than just your tax professionals; we’re partners in your financial well-being.

We believe in transparency, ethics, and professionalism. We’re not here just to help you get through an IRS tax audit; but to ensure you feel empowered, informed, and confident about your tax situation.

Our clients trust us for our thorough understanding of tax laws and our personalized approach to every case. Not to mention, it is our unwavering commitment to their interests that keeps us going!

Remember, an IRS tax audit is not a verdict; it’s a process – one that we can help you navigate effectively and efficiently. So, why wait? Let’s take the first step toward resolving your tax worries!

Take Control of Your Tax Situation Now!

We’re proud to have aided countless individuals and businesses in saving significant amounts in taxes. Our expertise and dedication have helped our clients navigate through IRS tax audits with confidence and ease, saving millions collectively.

It’s never too late to be part of our success story!

Don’t let the stress of an IRS audit weigh you down. Choose Bowes and Associates and let our experts guide you through the process, ensuring the best possible outcome. Take the first step towards securing your financial future.

Together, we can make your IRS tax audit a hurdle of the past.

Frequently Asked Questions

Writing an IRS tax appeal letter involves clearly stating why you disagree with the IRS’s decision and providing evidence to support your case. Bowes & Associates will help you craft a strong, fact-based appeal that highlights discrepancies and strengthens your position, increasing your chances of success.

Yes, Bowes & Associates offers a wide range of tax-related services. Whether you’re dealing with an IRS audit, a tax lien, or wage garnishment, we provide comprehensive support to help you resolve all your tax issues efficiently.

If you’re due a refund and are selected for IRS tax audits, the IRS typically holds your refund until the audit is complete. Bowes & Associates will ensure that your audit is handled efficiently, resolving any issues so you can receive your refund as quickly as possible.

If the IRS finds discrepancies during an audit, you may face additional taxes, penalties, and interest. In more serious cases, fraud accusations can lead to higher fines or criminal charges. Bowes & Associates will represent you during the audit, helping reduce penalties and providing a strong defense to protect your rights.

If you’re unable to pay your tax debt after an audit, Bowes & Associates can negotiate on your behalf with the IRS. Options like an Offer in Compromise or a payment plan can make your tax debt more manageable.

If significant errors or fraud are discovered, the IRS may impose fines or even criminal charges. Bowes & Associates will defend your case, working to minimize penalties and protect you from the most severe consequences while ensuring your rights are upheld throughout the process.

The timeframe for collecting back taxes depends on the state, usually ranging from 3 to 20 years. Certain actions, like failing to file or filing fraudulently, can extend this period. Bowes & Associates will work with you to resolve tax issues quickly, helping you avoid further complications and penalties.

While no one can guarantee that you won’t be audited again, Bowes & Associates ensures that your tax filings are accurate and compliant, which can greatly reduce the risk of future IRS audits.